A column within the file identifies changes made from the previous version In the blog post, I used an example to introduce the common functions in ‘Account Payable’ modules. Business Rulesīusiness Rules are posted in two different formats which contain identical information - Adobe (PDF) and a comma-separated file (CSV). In the document, we can see 200 Euro has been added to the debit side of the vendor account as the credit memo.

#Debit memo password

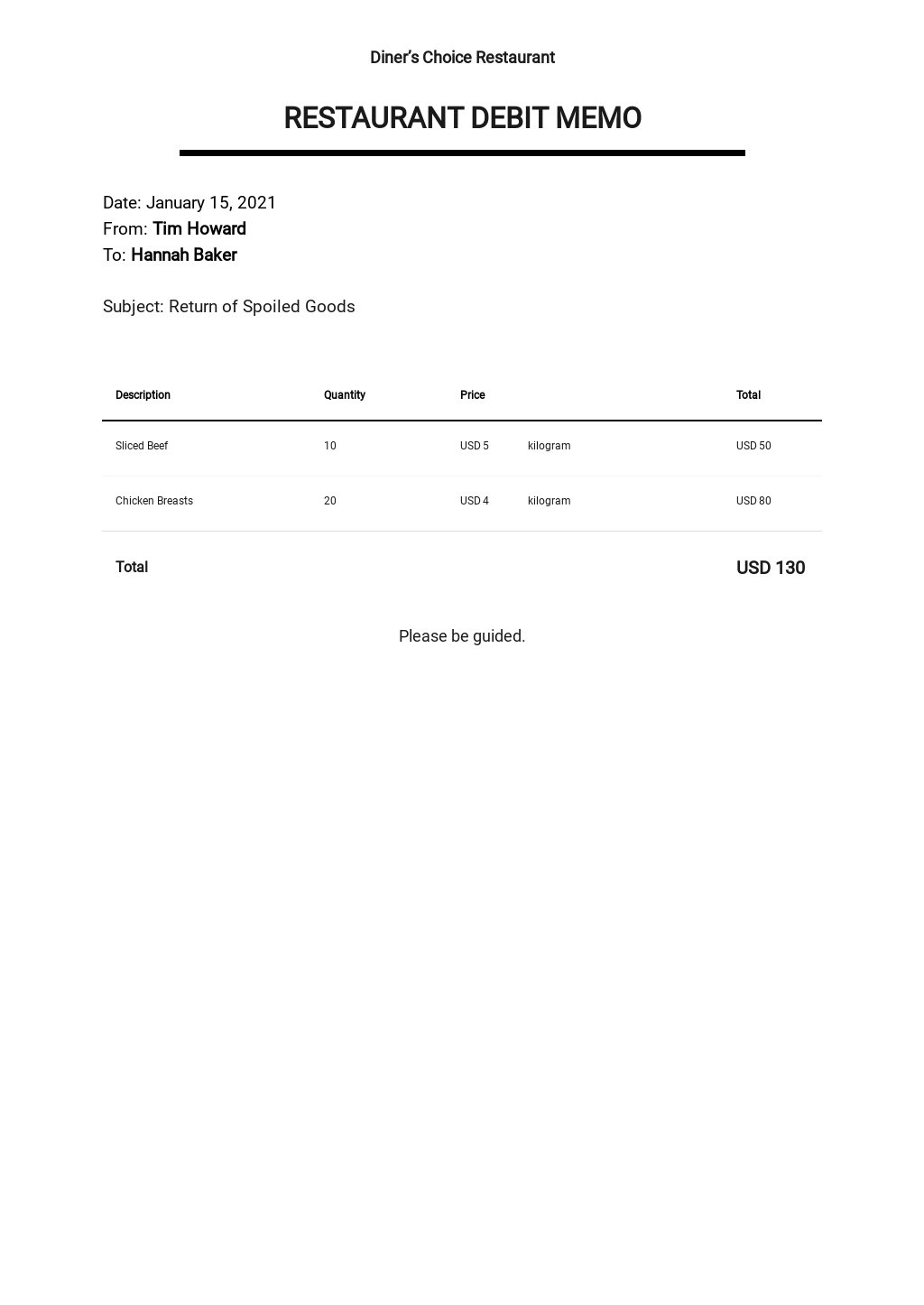

Note: You can access the login page, register for e‐services, reset your password and make changes to your existing account on e-Services Online Tools for Tax Professionals. Debit memos must include the reason for the memo, along with the date and amount for which accounts payable must be adjusted. This increases receivables in Financial Accounting. We encourage you to review your e-file application currently to verify you have the appropriate role and to verify you have access to your e-Services account. Debit memo: A billing document created on the basis of a debit memo request. Debit memos that are not paid within 90 days of issuance will be reactivated and a. If you are a registered user in e-services and are listed on a state e-file application, you will receive this distribution. Each debit memo issued by JetBlue Airways is subject to a 50 Service Charge. (Release 9. Your role on the e-file Application must be Principal, Responsible Official, or a Delegated User with MeF authorities. To enter a debit memo, you follow the steps to enter a standard voucher, but enter the gross amount as a negative amount on the Enter Voucher-Payment Information form.

#Debit memo software

To receive the distribution of Schema packages, you must have an active e-services account and be listed on an e-file application with the provider option of Software Developer.

The XML standardization was applied and are available for program planning purposes. Included in the 2023v1.0 Schema package are "DIFF" files which identify the difference between the 2022v6.0 Schema package and the 2023v1.0 Schema package.

We are providing Tax Year 2023 Extensible Markup Language (XML) Schemas and Business Rules for the following forms that include new tax year form(s) and tax law changes. A debit note is a document used by a vendor to inform the buyer of current debt obligations, or a document created by a buyer when returning goods received on credit.

0 kommentar(er)

0 kommentar(er)